MPC meeting keeps Repo, Reverse repo rates unchanged

text_fieldsMumbai: Repo rate will continue hover at 4 per cent, while the Reverse repo rate is to be pegged at 3.35 per cent, reports say.

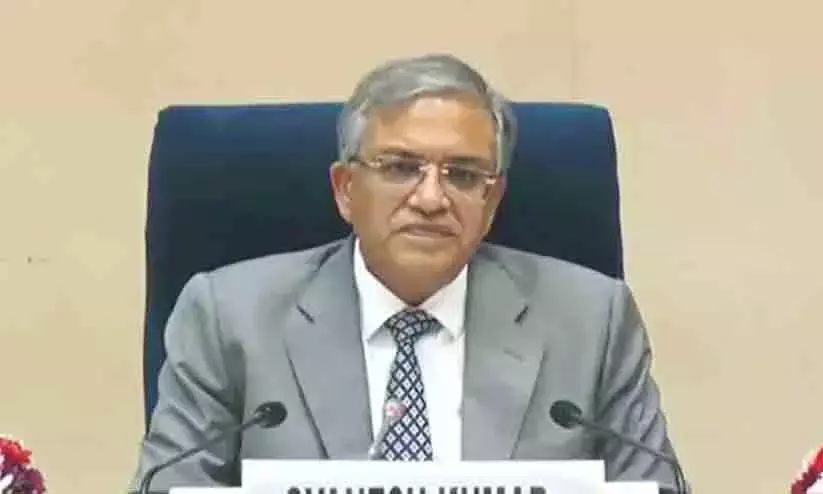

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) made the decision on the key police rate on Friday, according to The Indian Express

As an additional tool to absorb liquidity, RBI introduced the Standing Deposit Facility (SDF) at an interest rate of 3.75 per cent.

The central bank retained its accommodative policy stance but hinted that it will be less accommodative in the wake of elevated inflation levels, the report said.

For fiscal 2022-23, the GDP growth is slashed to 7.2 per cent while the inflation forecast is put at 5.7 per cent.

The unchanged Repo rates reportedly would help banks to keep interest rates unchanged in the financial system, aiding economic growth.

Borrowers won't have to shell out more on EMIs and loan repayments at least for the time being, the report said.

As per the report, a stable Reverse repo rate allows the central bank to retain the money, or liquidity, in the banking system. A hike on the other hand would eventually lead to a rise in rates.

As a tool to absorb liquidity, the RBI has decided to institute the SDF with an interest rate of 3.75 per cent with immediate effect.

The SDF at this given rate will replace the fixed rate reverse repo (FRRR) as the floor of the LAF corridor.

Both the standing facilities – the MSF and the SDF – will be available on all days of the week, throughout the year, the report said.

According to RBI Governor Shaktikanta Das said Ukraine crisis poses a new and overwhelming challenge, complicating an already uncertain global outlook.

He added that RBI is braced up to defend the Indian economy with all instruments at its command. Das also said that India could not be hostage to any rulebook and no action would be off the table to safeguard the economy.