Return of Manusmriti as a civilisational code

text_fieldsI have a friend who refuses to accept interest on his bank deposits. It is not because he dislikes money or distrusts banks. Rather, his religious belief tells him that earning interest is unethical. For him, money should be earned through work or trade, not through usury.

He owns one of the oldest houses in our ancestral town. It stands on a large plot of land and has seen generations grow up and move away. He has only one son. When the boy gained admission to a medical college, my friend sold a portion of his land to fund his education. It was a difficult decision, but education came first.

Instead of depositing the money in a bank, my friend did something unusual. He rented space in the bank’s security vault—a locker—and kept the cash there. He did not want interest, only safekeeping. He trusted the bank more than his own cupboards.

Then came Prime Minister Narendra Modi’s announcement of demonetisation. Overnight, high-denomination currency notes were declared invalid. I remember thinking my friend had lost everything. His was not black money; it was the proceeds from the sale of ancestral land, fully legal and accounted for.

Fortunately, the government allowed demonetised notes to be deposited in banks for a limited period. My friend managed to get his money exchanged. I do not know where he finally kept it. But the episode stayed with me. It raised a basic question: why should someone who does not want interest be forced into a system built entirely around interest?

This question grew sharper when Kerala tried to start an Islamic bank. In 2010, the Kerala government’s plan to launch such a bank was stayed by the Kerala High Court following a case filed by Dr Subramanian Swamy, an ideologue of the erstwhile Bharatiya Jan Sangh. He argued that state participation in a religion-based bank violated Articles 14 and 25 of the Constitution.

The RBI also opposed Islamic banking, stating that interest is mandatory under the Banking Regulation Act, 1949. The Kerala State Industrial Development Corporation’s proposed stake was halted. Eventually, in 2013, the RBI allowed a compromise: a Sharia-compliant Non-Banking Financial Company named Cheraman Financial Services Limited. Alas, the company did not take off.

The fear then was that Sharia law was being used to introduce religion into finance—a fear that derailed the project.

Had the proposal taken concrete shape, it would have helped people like my friend—people who simply want a safe place to keep their money without violating their conscience. I still do not understand why banks cannot accept deposits on which the depositor does not want interest. After all, banks already accept current account deposits that earn no interest.

Interestingly, a friend of mine—a Hindu Brahmin—was selected to join the proposed Sharia-compliant bank. He had spent decades heading Islamic banking operations for a major bank in Oman. His expertise was unquestionable. Yet, because the project was stalled and slowed down, he lost a job opportunity. Ironies abound.

Around that time, it was reported that then Prime Minister Manmohan Singh, a former Governor of the Reserve Bank of India, asked the RBI to explore ways to help people who wanted safekeeping, not interest, for their deposits. Nothing tangible came of it.

The issue of interest is often misunderstood as uniquely Islamic. It is not. The Bible strongly condemns charging interest—often called usury—on loans to people in need. The Old Testament forbids charging interest to poor Israelites. The New Testament urges believers to lend without expecting anything in return. Opposition to interest exists across religions and cultures.

Of course, one valid argument is that a secular government should not promote any religion. That principle is important. But the question remains: is refusing interest a religious demand, or a personal ethical choice?

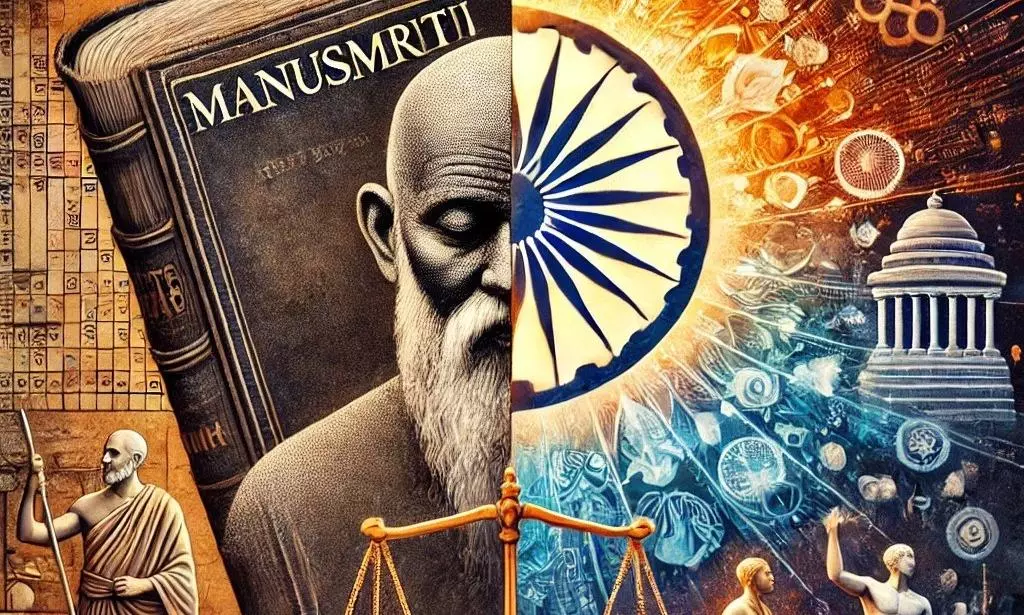

This brings us to a troubling contrast. Earlier this month, the Supreme Court cited Manusmriti (Chapter 8, Verse 389) while ruling that a widowed daughter-in-law may be entitled to maintenance from her deceased father-in-law’s estate. The Court quoted the verse to stress the moral duty of a family head to support dependent women. It applied this alongside the Hindu Adoptions and Maintenance Act, 1956, to prevent destitution.

While the legal outcome has saved a woman from destitution, the use of an ancient religious text raised questions about secularism. The ruling implied that traditional Hindu law could inform modern judicial reasoning, even in a constitutional democracy.

This raises an uncomfortable question: can a secular nation that insists everyone with a bank account must accept interest on deposits freely quote the Manusmriti to reach a judicial verdict?

On the one hand, there is intense fear that Sharia principles—even when voluntarily chosen and limited to financial ethics—will undermine secularism. On the other hand, an ancient Hindu religious text is cited approvingly by the highest court of the land.

Let us not forget what the Manusmriti actually contains. It includes numerous provisions that are anti-women, anti-Dalit, and deeply unequal. It legitimises caste hierarchy, denies dignity to the lower castes, and restricts women’s autonomy. Dr B. R. Ambedkar publicly burned the Manusmriti because he saw it as incompatible with equality, liberty, and fraternity.

There is another flaw in the court’s reasoning. It assumes the existence of an estate. What if the deceased father-in-law was poor and left nothing behind? From where would the widowed daughter-in-law get support? Moral duties cannot replace material reality.

In India, children—sons and daughters—often support their parents regardless of gender. But when families fail, it is the state’s responsibility to step in. That is why pensions, social security schemes, and welfare measures exist. Justice cannot depend on religious texts or family property alone.

The real danger lies elsewhere. If two judges today find wisdom in Manusmriti, what happens tomorrow when more judges rely on it to justify conclusions that openly clash with the Constitution? The slippery slope is real.

This fear is not imaginary. A large section of Hindutva supporters openly argues that the Manusmriti should guide the nation’s laws. They see it not as a historical text but as a civilisational code. That should worry every citizen who values constitutional morality.

And that brings us back to the original irony. A man cannot keep his money safely in a bank without interest because it is seen as a religious intrusion. But a court can cite Manusmriti—a text Ambedkar rejected—to strengthen its reasoning.

The contrast is stark. Sharia is feared, regulated, and stalled. Manusmriti is quoted, normalised, and legitimised. In a truly secular republic, neither fear nor endorsement should be selective. The Constitution—not religious law, ancient or modern—must remain the only guiding text.