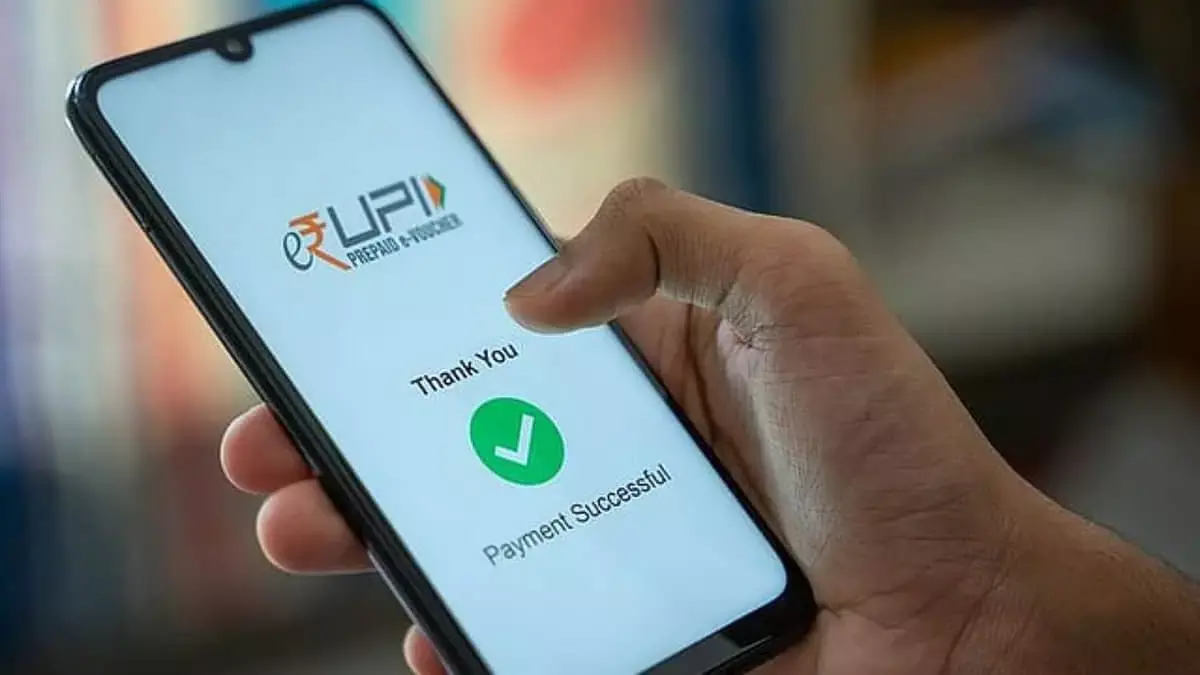

India's UPI payment system now available in Qatari supermarkets

text_fieldsDoha: India expanded the reach of its Unified Payments Interface (UPI) in Qatar on Monday with the launch of the facility at Lulu Group stores, following its introduction at duty-free outlets in Hamad International Airport last month.

Commerce and Industry Minister Piyush Goyal inaugurated the service at a Lulu store, highlighting that it would facilitate smoother and more cost-effective movement of capital between the two countries. He encouraged other banks and institutions in Qatar to adopt UPI, emphasising its potential to revolutionise trade.

“The launch of UPI is not just a digital payment solution but an opportunity to expand trust between Qatar and India. By integrating our payment systems, people will be able to trade more efficiently and at lower costs,” Goyal said. He added that money transfers and capital movements will be faster, almost on a real-time basis, and at “very-very low” costs.

The rollout is a collaboration between NPCI International Payments Ltd (NIPL), Qatar National Bank (QNB), and Japanese payments gateway NETSTARS. Last month, NIPL and QNB had introduced UPI at point-of-sale terminals across Qatar for merchants acquired by QNB.

Goyal noted that the system would benefit the 830,000 Indians living in Qatar, allowing faster and cheaper remittances. With this launch, Qatar becomes the eighth country to accept UPI, enabling real-time, cashless payments for Indians and reducing reliance on foreign currency or international cards.

By facilitating seamless transactions, UPI supports both Indian travellers and Qatari businesses, promotes digital payment adoption, strengthens India’s international financial footprint, and enhances convenience and security for tourists in high-traffic commercial areas.

Launched nine years ago, UPI has become a major success in India. “Eighty-five per cent of Indian digital payments go through UPI, and nearly 50 per cent of global digital payments are now made via UPI,” Goyal said, noting that the platform handles an average of 640 million transactions daily.

He also praised QNB for acting as a bridge between NPCI, which developed the UPI platform, and Lulu Group, which is now offering digital payment facilities to all its customers.

With PTI inputs