An RBI rate hike is around the corner, warns experts

text_fieldsThe Reserve Bank of India is likely to increase the benchmark lending rate due to the threat of inflation, said experts. The changes may be made in the forthcoming monetary policy review on Wednesday.

The central bank is expected to go for at least a 35 basis points (bps) hike over and above the 40 bps hike effected last month. Experts are anticipating more hikes in repo rate in the coming months. Governor Das-headed MPC will meet for three days beginning Monday.

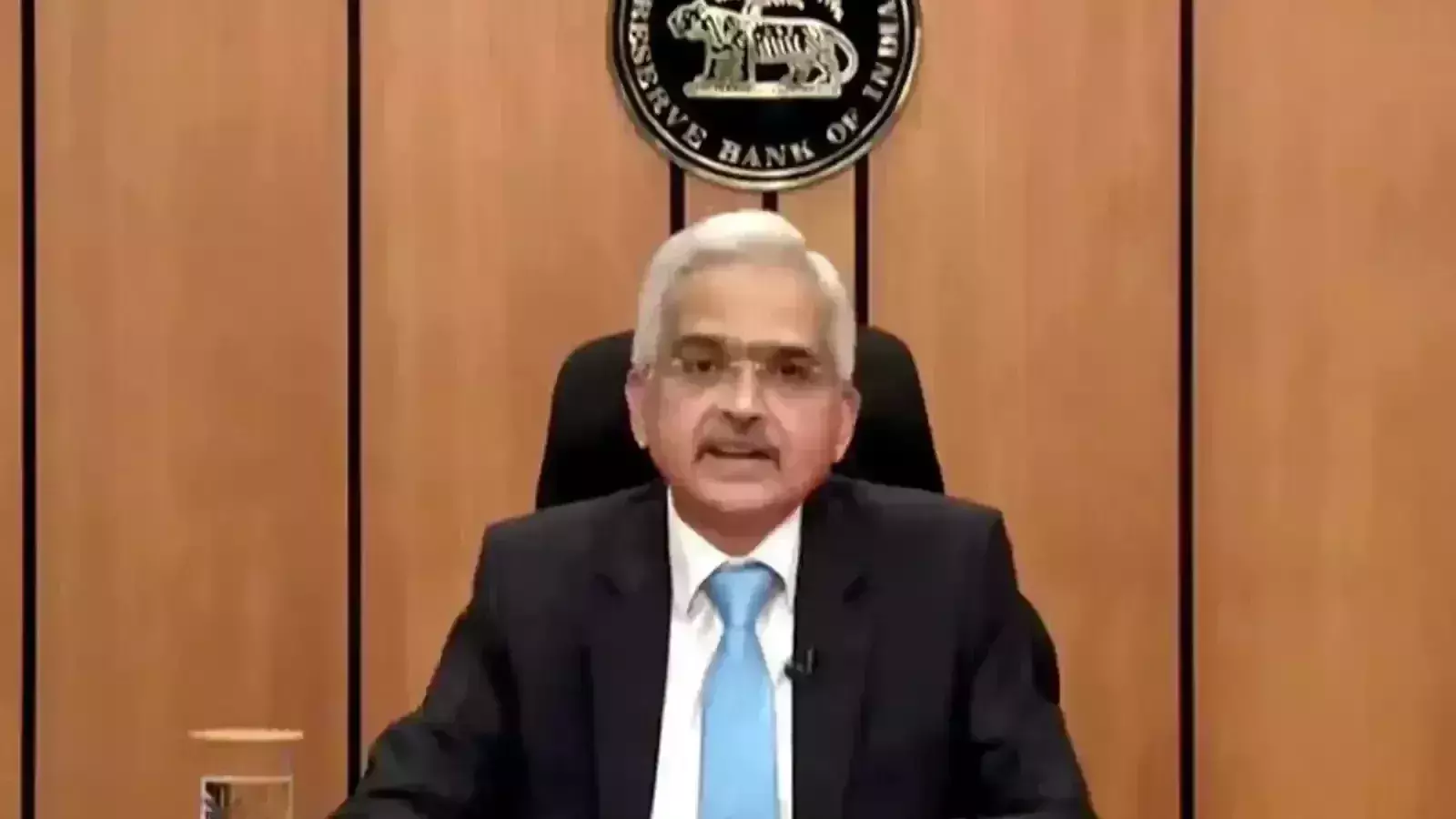

Governor Shaktikanta Das has already hinted at the rate hike.

Governor Das said the expectation of a rate hike is a no-brainer. "There will be some increase in the repo rates, but by how much I will not be able to tell now but to say that 5.15 may not be very accurate," he said in an interview.

The retail inflation increased for a seventh straight month to touch an 8-year high of 7.79% in April. The increasing cost of fuel and other commodities due to the ongoing Russia-Ukraine war is the major reason. The wholesale price-based inflation has remained in double digits for 13 months. It reached a record high of 15.08% in April.

Madan Sabnavis, Chief Economist at Bank of Baroda, said the credit policy that will be announced on Wednesday is going to be important from the point of view of rate action and the RBI's thoughts on growth and inflation.

The increase in repo rate can be taken as almost given, but the quantum may not be more than 25-35 bps. The earlier minutes of the meeting held in May indicated that the MPC was not in favour of a large increase in repo rate at one shot, he added.

Dhruv Agarwala, Group CEO of Housing.com, PropTiger.com & Makaan.com, said the RBI is expected to increase the repo rate again but it should be gradual.