Begin typing your search above and press return to search.

exit_to_app

exit_to_app

Posted On

date_range 25 July 2022 3:22 PM IST Updated On

date_range 25 July 2022 4:46 PM ISTYou need an OTP to withdraw cash from SBI ATMs, others likely to follow it

text_fieldsbookmark_border

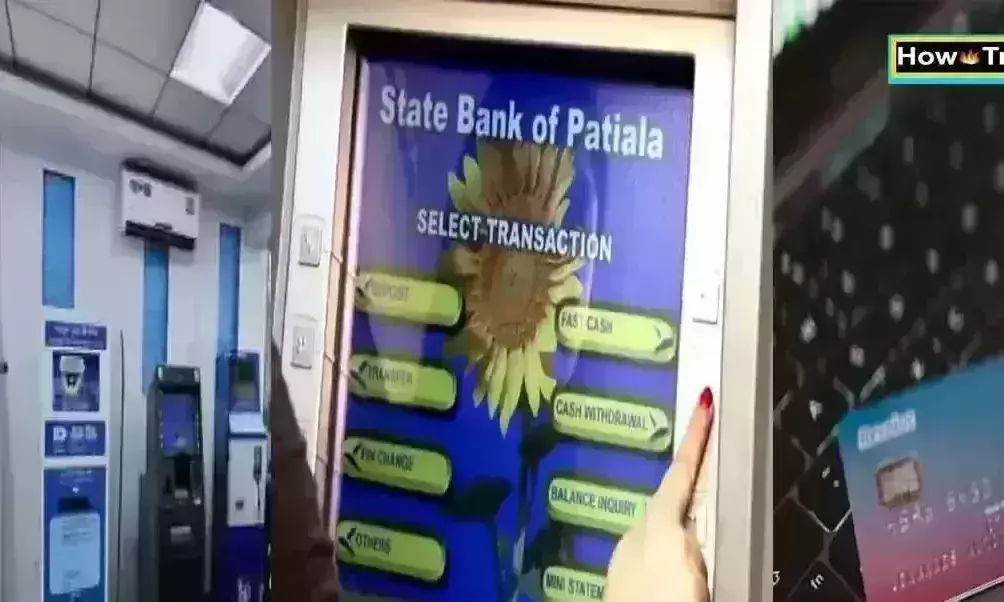

Mumbai: The customers of the State Bank of India have to enter the One Time Password that is being sent to the registered mobile phone to withdraw money from ATMs. The SBI has launched such a system with a view to preventing fraudulent ATM transactions.

It is expected other banks will also follow the OTP based cash withdrawal system in coming days. The OTP will authenticate the cash withdrawal and it will be valid for only one transaction.

The largest lender in the country launched the OTP-based cash withdrawal services on January 1, 2020.

How OTP works at ATM:

- Henceforth, you have to carry a mobile phone along with the Debit card to withdraw cash from SBI ATMs

- Once you insert your debit card and enter the ATM PIN along with the withdrawal amount, you will be asked for the OTP

- The OTP will be asked after the regular process of withdrawing cash from ATM to complete the transaction

- The OTP will be received on your registered mobile number via SMS

- Enter the OTP received on your phone on the ATM screen

- The transaction will be completed once you enter the valid OTP

Next Story