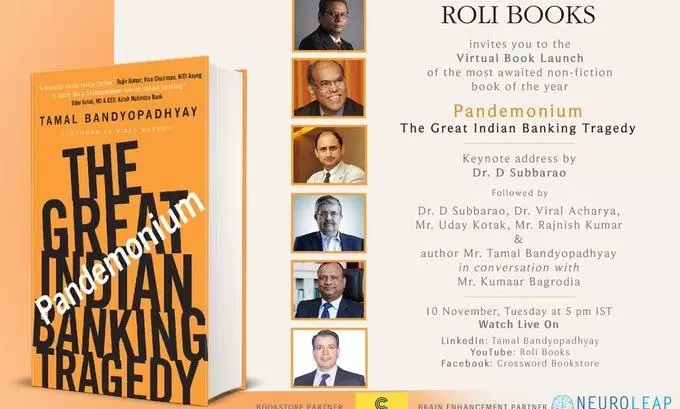

Tamal Bandyopadhyay's detailed account on 'Indian Banking Tragedy' coming on November 10

text_fieldsNoted journalist Tamal Bandyopadhyay's latest book 'Pandemonium: The Great Indian Banking Tragedy' which is expected to release on 9 November by Roli Books promises an insider's perspective on the rot in India's Banking system. It also includes interviews with four RBI governors- C Rangarajan, YV Reddy, D Subbarao and Raghuram Rajan.

The Print reports quote of Subbarao in the upcoming book "Yes, the bad loan problem is big and real. But what is also big and real is the fiscal constraints of the government". Former RBI chiefs also warned that India's economic recovery will be hit if banks aren't recapitalised.

In the released excerpt of the new book, Bandyopadhyay observed the rise of Infrastructure Leasing & Financial Services (IL&FS) broke all sorts of laws and regulation. "Going by the RBI norms, a crore investment company can borrow up to 2.5 times its net worth, but IL&FS stretched it to many times more. It tapped every available source in its borrowings" he marked. Bandyopadhyay accused that instead of being a catalyst for infrastructure creation, IL&FS ended up in working in completely unrelated fields. According to him the group of directors- who he called 'gang of nine'- exercised control over the group and the blame for collapse for IL&FS must be shared between CEO, management, the board, auditors, rating agencies as well as equity holders, who had representatives on the board but allowed the 'gang of nine' to make things in their ways.

"Tamal Bandyopadhyay's latest book is the ultimate insider account of what's happening in Indian banking and financial system. This will be explosive" Navneet Munot, chief Investment Offices, SBI Mutual Fund commented.