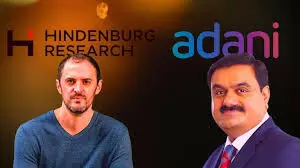

Hindenburg report over Adani: SEBI issues showcase notice

text_fieldsMumbai: The Hindenburg Research, Nathan Anderson, and the entities of Mauritius-based foreign portfolio investor (FPI) Mark Kingdon received a show-cause notice from the Securities and Exchange Board of India (SEBI) for trading violations in the scrip of Adani Enterprises Ltd, leading up to the Hindenburg report and thereafter.

In the 46-page show-cause notice, The markets regulator has alleged that Hindenburg and Anderson violated regulations under the SEBI Act, SEBI’s Prevention of Fraudulent and Unfair Trade Practices regulations, and its Code of Conduct for Research Analyst regulations.

Meanwhile, FPI Kingdon has allegedly violated SEBI Act, SEBI’s Prevention of Fraudulent and Unfair Trade Practices regulations and SEBI’s Code of Conduct for Foreign Portfolio Investors, according to the show-cause notice.

The markets regulator pointed out that the Hindenburg and the FPI entities undertook a misleading disclaimer that the report was solely for the valuation of securities traded outside India when it clearly pertained to listed entities in India.

The regulator said Kingdon aided Hindenburg to indirectly participate in Adani Enterprises by collaborating with the short seller to trade in the company's futures in the Indian derivatives market and shared profits with the research firm.

Hindenburg continues to defend its report that came out in January 2023.

Source: IANS