Pakistan secures $7 billion loan from IMF to revive economy

text_fieldsThe International Monetary Fund (IMF) has announced a $7 billion loan agreement with Pakistan to help stabilize its struggling economy.

In return, Islamabad has committed to implementing further unpopular reforms, such as broadening the country’s persistently low tax base.

Pakistan faced near-default conditions last year as the economy deteriorated due to political instability, devastating monsoon floods, and years of economic mismanagement, compounded by a global downturn. Emergency loans from friendly nations and the IMF prevented a complete economic collapse, but the country still grapples with high inflation and substantial public debt.

The new three-year agreement, pending IMF Executive Board approval, aims to "cement macroeconomic stability and create conditions for stronger, more inclusive, and resilient growth," according to an IMF statement on Friday.

Negotiations between Islamabad and IMF officials took months to unlock the new loan, marking Pakistan’s 24th payout from the IMF in over six decades. The agreement requires extensive reforms, particularly in expanding the tax base. Despite a population of over 240 million, only 5.2 million individuals filed income tax returns in 2022.

For the 2024-25 fiscal year, beginning in July, the government plans to raise nearly $46 billion in taxes, a 40% increase from the previous year. Innovative methods, such as blocking 210,000 SIM cards of non-tax filing mobile users, are being employed to widen the tax net. Additionally, Pakistan aims to reduce its fiscal deficit by 1.5% to 5.9%, another critical IMF condition.

Despite these efforts, Pakistan's public debt stands at $242 billion, with debt servicing expected to consume half of the government's income in 2024. Analysts have criticized the reforms as superficial, aimed more at satisfying IMF conditions than addressing deep-rooted issues.

Ali Hasanain, an associate professor of economics at the Lahore University of Management Sciences, told AFP, "It is hard to not see old patterns in this new IMF deal," questioning whether authorities will use this opportunity to implement fundamental reforms.

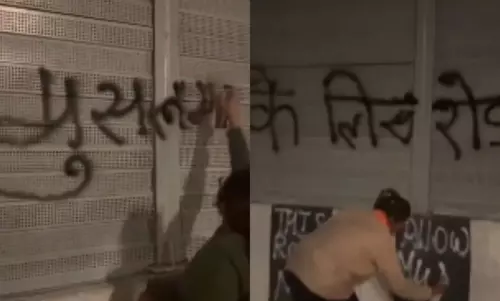

Prime Minister Shehbaz Sharif faces a significant challenge in maintaining public support amid strict economic measures. Protests have already erupted over tax and bill increases introduced in the recent budget, prepared under IMF supervision, with more demonstrations anticipated.

With around 40% of the population living below the poverty line, the World Bank warned in April that an additional 10 million Pakistanis could fall into poverty. The previous $3 billion IMF loan in 2023 provided essential relief but also demanded unpopular austerity measures, including ending consumer subsidies.

While the current account balance has shown some recovery and inflation has begun to ease, the IMF projects 2% economic growth this year. However, inflation is expected to remain high, reaching nearly 25% year-on-year, before gradually decreasing in 2025 and 2026.