OCCRP report exposes SEBI's awareness of Adani Group's stock fraud allegations

text_fieldsMumbai: A document obtained by the Organised Crime and Corruption Reporting Project (OCCRP) has exposed that India's stock market regulator, the Securities and Exchange Board of India (SEBI), had knowledge of allegations against the Adani Group dating back nearly a decade.

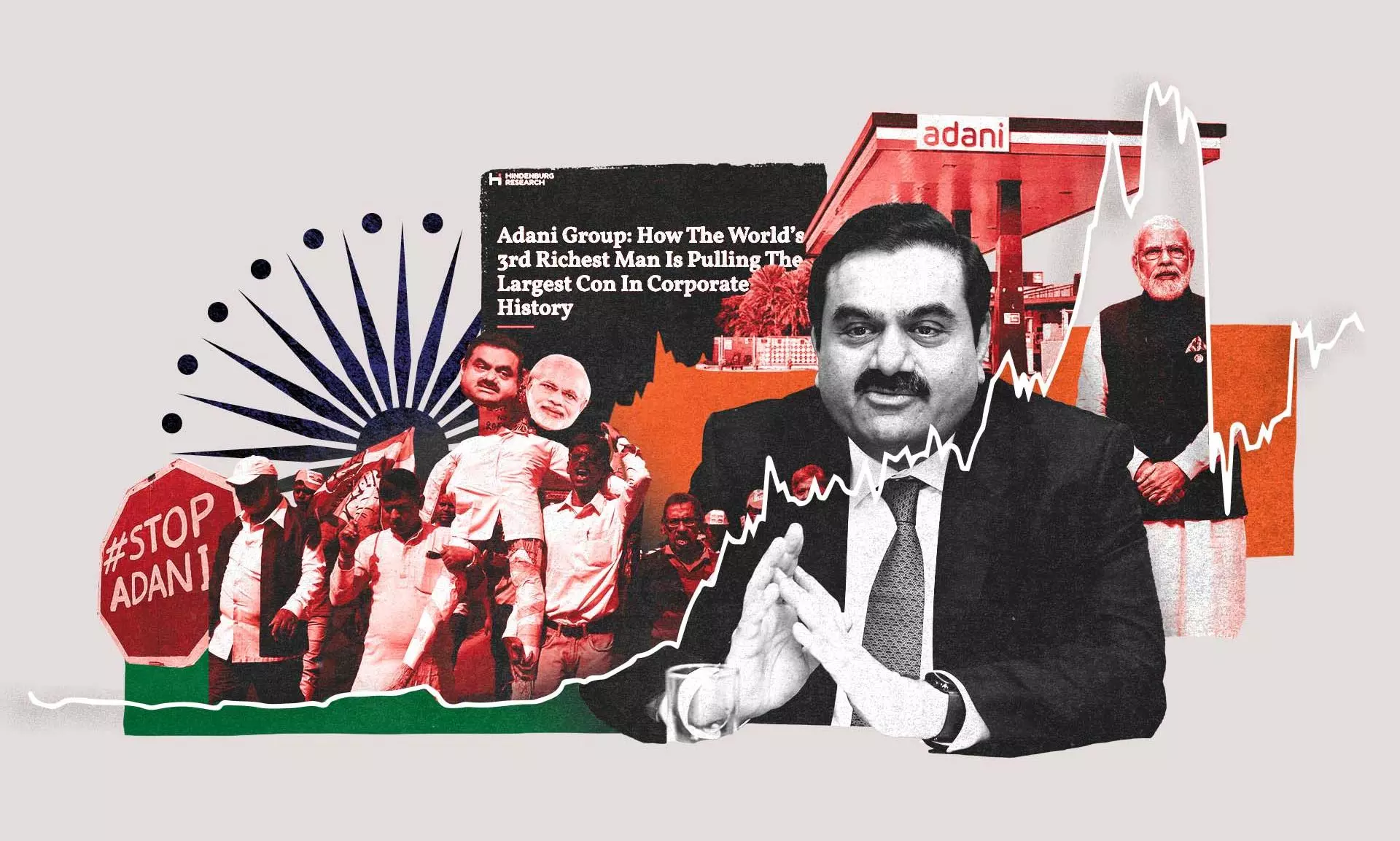

This revelation comes after American investment firm Hindenburg Research accused the Adani Group of stock manipulation earlier this year, causing significant disruptions in the conglomerate's shares.

In January 2014, the Directorate of Revenue Intelligence (DRI), a financial investigative agency under the Ministry of Finance, sent a letter to the SEBI chairman at the time, UK Sinha, highlighting an investigation into alleged over-invoicing of power equipment purchased by an Adani Group company.

The letter stated that the proceeds from this alleged over-valuation, amounting to an estimated Rs 6,278 crores, had been transferred to Mauritius. Notably, the DRI also indicated that some of this money might have found its way into the Indian stock markets through investments and disinvestments in the Adani Group.

The OCCRP report indicates that it remains unclear whether Sinha acknowledged the letter or took any action in response. Sinha, who served as SEBI chairman from 2011 to 2017, mentioned that he could not recall the details of the letter and stressed that he had retired from SEBI six years ago.

However, Sinha's appointment as an independent director of NDTV earlier this year has raised eyebrows, especially given that the Adani Group had recently taken control of the news organization. When questioned about the timing of his appointment, Sinha denied any link between his directorship and actions taken during his tenure at SEBI.

Transparency activist Arun Aggarwal alleged that SEBI's failure to thoroughly investigate the allegations against the Adani Group could be more than just an oversight, suggesting possible connivance.

These allegations come in the wake of recent revelations by OCCRP, which, in collaboration with the Financial Times and The Guardian, identified two individuals, Nasser Ali Shaban Ahli and Chang Chung-Ling, who used offshore funds based in Mauritius to invest hundreds of millions of dollars into the Adani Group. Both individuals had significant business ties with the Adani Group, particularly Vinod Adani, the brother of the conglomerate's chairman, Gautam Adani.

OCCRP's allegations have significant implications, as they corroborate Hindenburg Research's claims that the Adani Group employed a network of offshore shell entities controlled by Vinod Adani to manipulate the valuation of its stocks. This manipulation allegedly led to an overestimation of the financial health of Adani's companies.

In response, the Adani Group vehemently denied these allegations, stating that independent adjudicating authorities had confirmed no over-valuation and that all transactions were in accordance with applicable laws.

While the OCCRP did not provide direct evidence linking Ahli and Chang's investments to the Adani Group, it did uncover a money trail indicating that Vinod Adani may have used one of these funds for his own investments. This money trail intersects with the DRI's 2014 investigation into the alleged over-invoicing of power equipment, suggesting a potentially deeper connection between these allegations.

Despite these allegations and investigations, the Supreme Court formed an expert panel to investigate possible regulatory failures related to the Adani Group earlier this year, also instructing SEBI to look into the allegations.

This move came after activist and Supreme Court lawyer Prashant Bhushan claimed that SEBI had been investigating the Adani Group since 2016, a claim that SEBI dismissed as "factually baseless."

However, in July 2021, the Minister of State for Finance, Pankaj Chaudhary, informed Parliament that SEBI was indeed examining some Adani group companies for non-compliance with regulatory regulations.

The expert panel's report reportedly emphasizes the challenges of identifying the true beneficiaries of foreign entities associated with the Adani Group, describing it as "a journey without a destination."

SEBI's own report to the court appears to echo these findings, underscoring the difficulty posed by the non-cooperation of tax-haven nations where these entities are located.