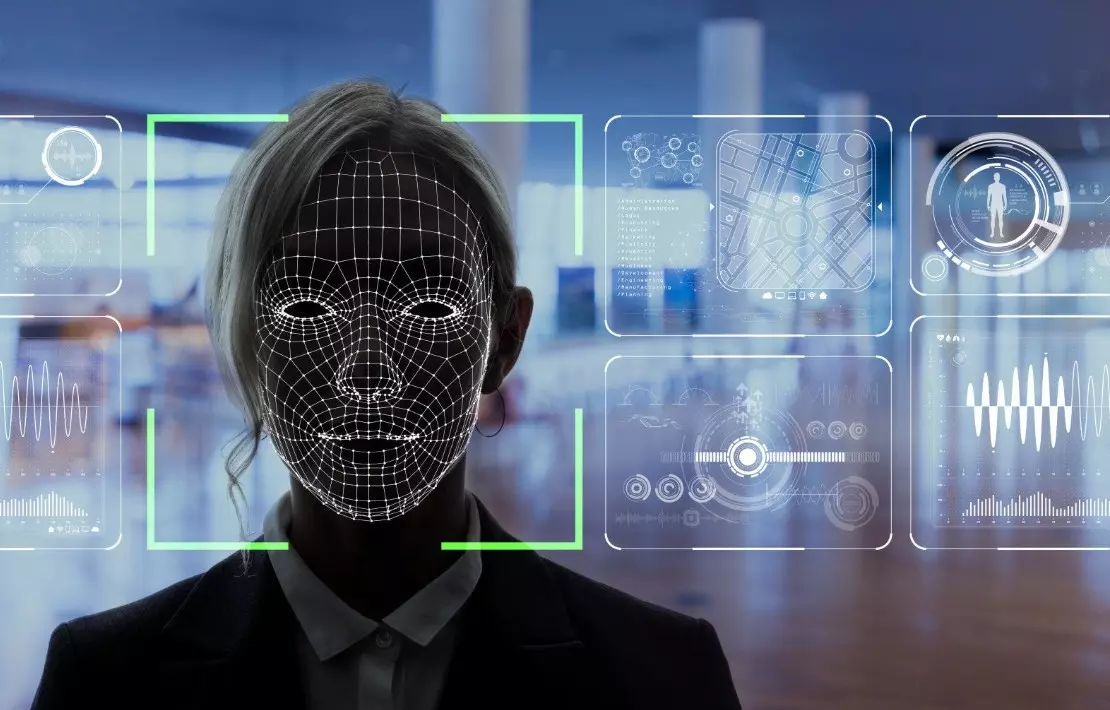

UAE residents can soon pay using their faces: Central Bank trials biometric payments

text_fieldsResidents in the UAE may soon be able to pay using their face or palm, after the Central Bank of the UAE introduced the region’s first biometric payment solution.

The system is currently in a proof-of-concept stage and is being demonstrated at the Dubai Land Department. Customers taking part in the pilot can complete payments by verifying their identity through facial or palm recognition, without using bank cards or mobile phones.

The Central Bank has not announced a timeline for expanding the service beyond the pilot phase. The trial is being implemented through the CBUAE’s Sandbox Program and Innovation Hub at the Emirates Institute of Finance, in partnership with Network International. The technology is powered by PopID.

According to the Central Bank, the pilot is operating in a controlled environment to evaluate security standards, transaction efficiency and operational readiness before any broader deployment.

Saif Humaid Al Dhaheri, Assistant Governor for Banking Operations and Support Services at the CBUAE, said biometric payments could strengthen transaction security and offer a smoother customer experience.

Network International chief executive Murat Cagri Suzer said biometric payment solutions are expected to become more prominent in digital commerce as banks and financial institutions look for alternatives to conventional payment methods.