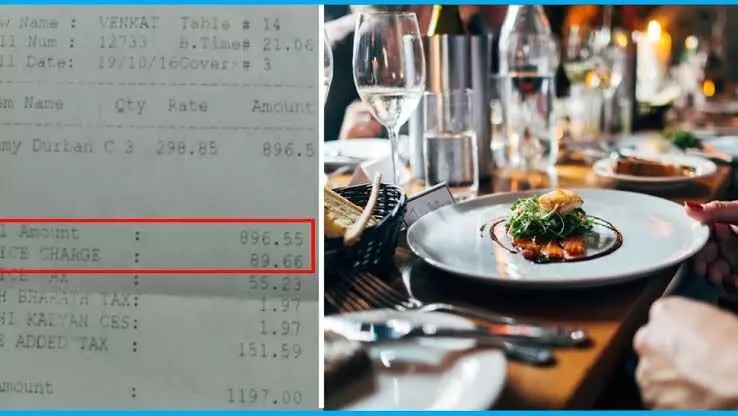

Hotels, restaurants cannot levy service charges anymore: CCPA issues guidelines

text_fieldsThe Central Consumer Protection Authority (CCPA) on Monday barred hotels and restaurants from levying service charges automatically or by default on food bills.

The authority, set up under the Consumer Protection Act, has issued detailed guidelines specifying the duties of eateries and the rights of customers and termed levying of service charges as an "unfair trade practice".

The guidelines are as follows:

(i) No hotel or restaurant shall add a service charge automatically or by default in the bill;

(ii) Service charge shall not be collected from consumers by any other name;

(iii) No hotel or restaurant shall force a consumer to pay the service charge and shall clearly inform the consumer that the service charge is voluntary, optional, and at the consumer's discretion;

(iv) No restriction on entry or provision of services based on a collection of service charge shall be imposed on consumers; and

(v) Service charge shall not be collected by adding it along with the food bill and levying GST on the total amount.

If any consumer finds that a hotel or restaurant is levying a service charge in violation of the guidelines, he/she/they can request the concerned establishment to remove it from the bill amount.

Consumers can also lodge a complaint on the National Consumer Helpline (NCH), which works as an alternate dispute redressal mechanism at the pre-litigation level, by calling 1915 or through the NCH mobile app.

Third, the consumer can complain to the Consumer Commission, or through the edaakhil portal, http://www.edaakhil.nic.in.

Fourth, he/she/they can submit a complaint to the District Collector of the concerned district for investigation and subsequent proceedings by the CCPA. A consumer can complain directly to the CCPA by sending an e-mail to com-ccpa@nic.in.

During the June 2 meeting, representatives of the hotel and restaurant industry told the Centre that the levy of service charge by a restaurant is a "matter of individual policy". There is "no illegality in levying such a charge", they said.

They also said that service charge brings in revenue to the government, since tax is paid on it.