LS passes Bill to decriminalise small offences, promote ease of doing business

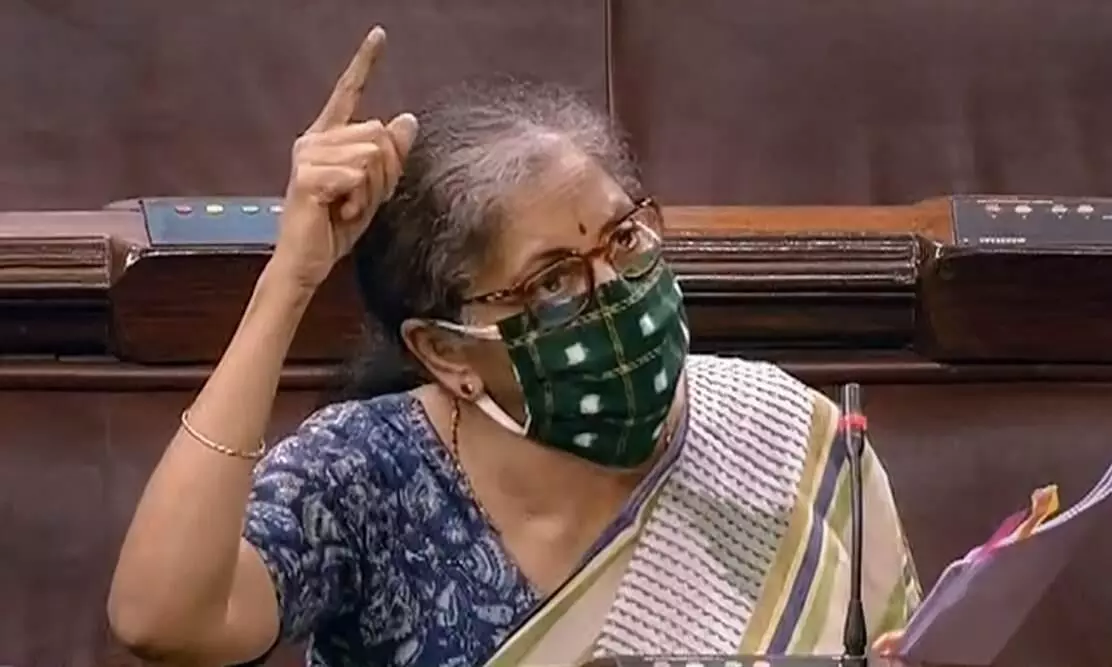

text_fieldsFinance Minister Nirmala Sitharaman, Image credit: PTI

New Delhi : The Lok Sabha on Saturday unanimously passed a Bill which has the provisions to promote ease of doing business and ease of living for corporates in India and decriminalisation provision for firms indulging in small offences.

The Companies (Amendment) Bill, 2020 seeks to amend the Companies Act, 2013. The Bill was moved in the Lok Sabha on March 17, 2020 to introduce certain modifications to the Companies Act, 2013.

Finance Minister Nirmala Sitharaman moved the Bill in the House for its passage after a marathon discussion while passing the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Bill, 2020.

The Bill was passed following a lengthy debate on Saturday evening, almost three hours after the scheduled time set for the House to run in the ongoing Monsoon Session that ends at 7 p.m.

The Finance Minister said that decriminalisation will benefit small MSMES (Micro, Small and Medium Enterprises).

"If we put these small businessmen into jail for small offences, it will affect their family," Sitharaman said.

The Minister said there were 134 penal provisions when the law was made in 2013 and now these have come down to 124 after the passing of the Bill.

However, the minister clarified that the number of serious offences or non-compoundable offences will remain the same as 2013 -- 35.

She explained that non-compoundable offences included frauds and those hurting public interest, and said "there is no provision to give the offenders relief under this law."

Sitharaman said, "When we talk about the amendments, there will be decriminalisation on 48 sections, providing ease of living by reducing the burden of paper work."

The minister said that the government is adding a new chapter to the Bill which will benefit producer organisations so that they can do direct business.

Under the 2013 Act, certain provisions from the Companies Act, 1956 continue to apply to producer companies. These include provisions on their membership, conduct of meetings, and maintenance of accounts.

Producer companies include companies which are engaged in the production, marketing and sale of agricultural produce, and sale of produce from cottage industries.

The Bill removes these provisions and adds a new chapter to the Act with similar provisions for producer companies.

The Bill makes three changes. First, it removes the penalty for certain offences. For example, it removes the penalties which apply for any change in the rights of a class of shareholders made in violation of the Act. Where a specific penalty is not mentioned, the Act prescribes a penalty of up to Rs 10,000 which may extend to Rs 1,000 per day for a continuing default.

Second, it removes imprisonment in certain offences. For example, it removes the imprisonment of three years applicable to a company for buying back its shares without complying with the Act.

Third, it reduces the amount of fine payable in certain offences. For example, it reduces the maximum fine for failure to file an annual return with the Registrar of Companies from Rs 5 lakh to Rs 2 lakh.

Under the Act, small companies are only liable to pay up to 50 per cent of the penalty for certain offences. The Bill extends this provision to all producer companies and startups.

The Bill empowers the Central government to allow certain classes of public companies to list classes of securities (as may be prescribed) in foreign jurisdictions. The Bill empowers the Central government, in consultation with the Securities and Exchange Board of India (Sebi), to exclude companies issuing specified classes of securities from the definition of a "listed company".

Under the Act, companies with net worth, turnover or profits above a specified amount are required to constitute CSR committees and spend 2 per cent of their average net profit in the last three financial years towards its CSR policy.

The Bill exempts companies with a CSR liability of up to Rs 50 lakh a year from setting up CSR committees.

Further, companies which spend any amount in excess of their CSR obligation in a financial year can set off the excess amount towards their CSR obligations in subsequent financial years.

The Bill also empowers the Central government to require classes of unlisted companies (as may be prescribed) to prepare and file periodical financial results, and to complete the audit or review of such results.

It also seeks to establish benches of the National Company Law Appellate Tribunal (NCLAT).