Sri Lanka crisis: individuals limited to possess only USD 10,000 in foreign currency

text_fieldsCOLOMBO: In a drastic move to raise the rapidly declining forex reserves needed to finance the import of essential commodities, including food and fuel, Sri Lanka hit by an acute economic crisis, has reduced the cap on a person's foreign currency holdings from USD 15,000 to USD 10,000.

Facing a severe forex crisis, Sri Lanka became the first Asia-Pacific country to default on foreign debt in decades after the island nation declared default on its international debt repayments in April.

The order was issued by Finance Minister Ranil Wickremesinghe under the Foreign Exchange Act to attract foreign currency into the formal banking system from the hands of the public.

"Reducing the amount of foreign currency retained in possession by a person in, or resident in, Sri Lanka from USD 15,000 to USD 10,000 or its equivalent in other foreign currencies," an official statement said.

The amnesty of 14 working days from June 16, 2022, is allowed for depositing or selling additional foreign currency to an authorized dealer.

The move comes a month after Central Bank of Sri Lanka Governor Nandalal Weerasinghe said that the Apex Bank was looking to reduce holdings in foreign currency from USD 15,000 to USD 10,000.

The governor had proof of possession document must be produced even if it was $ 10,000.

Sri Lanka is facing its worst economic crisis since independence in 1948, which has led to severe shortages of essential commodities such as food, medicine, cooking gas and fuel across the country.

After Colombo declared a default on loans in April, US bank Hamilton Reserve, a holder of Sri Lankan bonds, filed a lawsuit in the US district court in Manhattan over the breach of contract.

Sri Lankans languish in long fuel and cooking gas queues as the government is unable to find dollars to fund imports.

Indian credit lines for fuel and essentials have provided lifelines until the ongoing talks with the International Monetary Fund (IMF) could lead to a possible bailout.

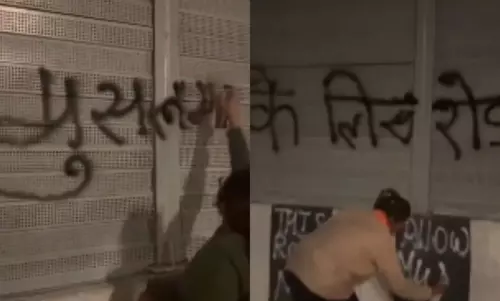

There have been street protests in Sri Lanka against the government since early April due to its mishandling of the economic crisis.

On May 9, the political crisis saw the unleashing of violence with 10 people, including a parliamentarian, being killed.

Source- PTI