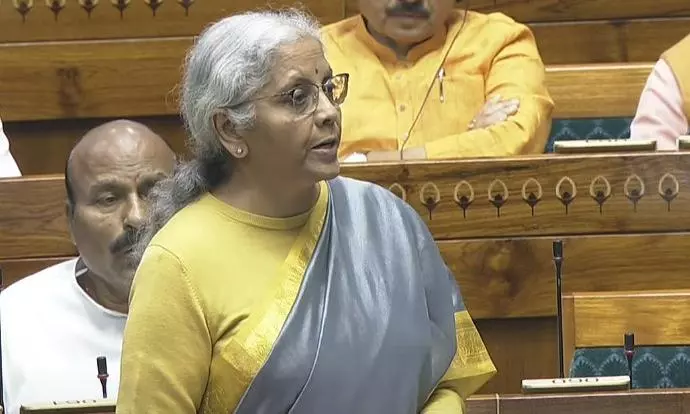

FM Sitharaman introduces new Income Tax Bill in Lok Sabha

text_fieldsFinance Minister Nirmala Sitharaman tables the new Income Tax bill today.

New Delhi: Finance Minister Nirmala Sitharaman on Thursday introduced the new Income Tax Bill, 2025, in the Lok Sabha, marking a major step in tax reforms aimed at simplifying and streamlining India’s tax laws. The proposed legislation seeks to replace the 64-year-old Income Tax Act, 1961, which has undergone numerous modifications over the decades, making it complex and difficult to interpret.

The bill will now be referred to the Select Committee of Parliament before it is tabled for final approval. If passed, the new law is expected to take effect from April 1, 2026. The introduction of the bill coincided with the conclusion of the first part of the Budget Session of Parliament, which ran from January 31 to February 13. The session will resume on March 10 and continue until April 4.

The primary objective of the new Income Tax Bill is to make tax laws more transparent, easier to interpret, and taxpayer-friendly. It aims to reduce legal disputes by replacing complex provisions with clearer language, encouraging voluntary tax compliance. The bill is also expected to introduce lower penalties for certain offences, making the system more lenient and fairer for taxpayers.

A key highlight of the new bill is its reduced length and simplified structure. The existing law consists of 823 pages and 819 sections, whereas the proposed bill condenses the framework to 622 pages with 536 clauses. It eliminates convoluted explanations and archaic provisions while simplifying terminology—for instance, replacing ‘assessment year’ with ‘tax year’—to make tax compliance more accessible.

Despite these reforms, the bill will not alter the existing tax slabs or revise tax rebates. Instead, its focus is on making the decades-old legislation more reader-friendly.

"This reform is a significant step towards modernising India's tax framework, bringing greater clarity and efficiency. The bill promises a more streamlined, accessible tax system, making it easier for citizens and businesses to fulfil their obligations while fostering trust in the system," said Rohinton Sidhwa, Partner at Deloitte India.

With IANS inputs