Centre spent GST Compensation Cess fund elsewhere, violated law: CAG

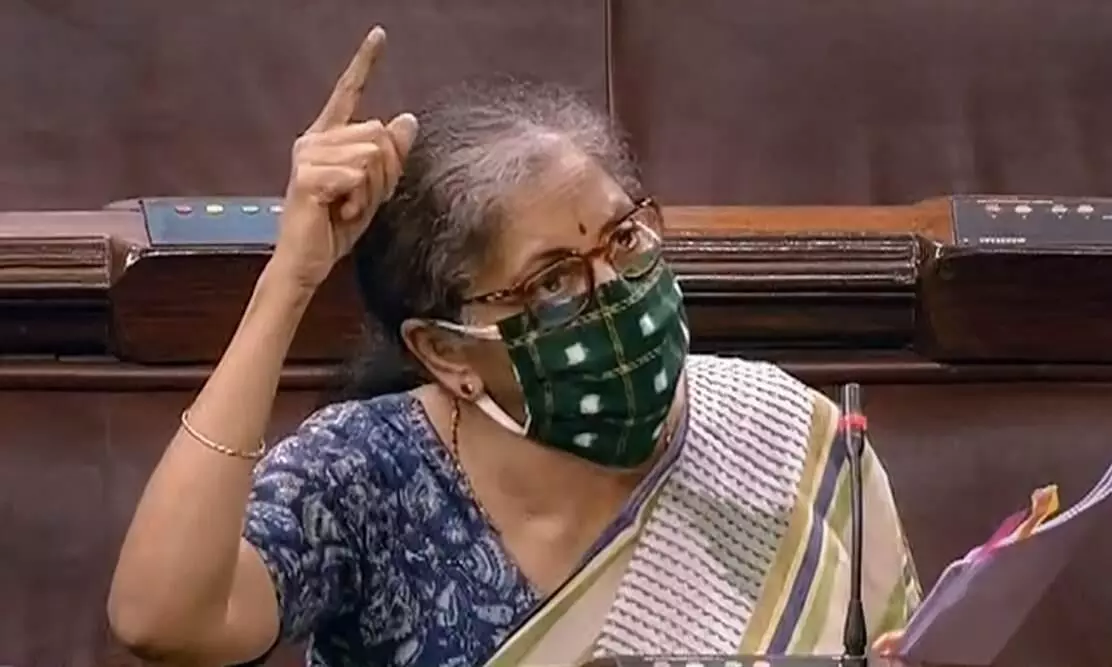

text_fieldsFinance Minister Nirmala Sitharaman, Image credit: PTI

New Delhi: The Comptroller and Auditor General of India has found that the Ministry of Finance has violated law on the Goods and Services Tax regime and spent Rs. 47,272 crore of the GST compensation cess that meant to be used specifically to compensate states for loss of revenue, during the financial year of 2017-'18 and 2018-'19.

The government auditor said the Centre used the fund for "other purposes", that resulted in "overstatement of revenue receipts and understatement of the fiscal deficit for the year". The short-crediting was a violation of the GST Compensation Cess Act, 2017.

The findings cited in a report on the accounts of the government for 2018-'19, tabled by the CAG in both Houses of Parliament on Wednesday.

The report on erroneous transfers by the Centre also came a week after Finance Minister Nirmala Sitharaman told Parliament that there was no provision in the law to compensate states for the loss of GST revenue out of the Consolidate Fund of India (CFI).

The GST (Compensation to States) Act guarantees all states an annual growth rate of 14% in their GST revenue during the period July 2017-June 2022. If a state's revenue grows slower than 14%, the Centre is supposed to compensate it using the funds specifically collected as compensation cess. The government auditor has now red flagged these funds were spent for other purposes.

The collected compensation cess flows into the Consolidated Fund of India, and is then transferred to the Public Accountant of India, where a GST compensation cess account has been created. States are guaranteed bi-monthly compensation from the accumulated funds in the account.

"The amount by which the cess was short credited was also retained in the CFI and became available for use for purposes other than what was provided in the act," CAG said.

"Short crediting of cess collected during the year led to overstatement of revenue receipts and understatement of fiscal deficit for the year."

The report elaborated that during 2018-'19, there was budget provision of Rs. 90,000 crore for transfer to GST Compensatiion Cess Fund and an equal amount was budgeted for release to states as compensation. However, even though the government collected Rs. 95,081 during the year as GST compensation cess, the Department of Revenue transferred only Rs. 54,275 crore to the Fund.

On an interesting note, the public auditor added that the Ministry of Finance has accepted the audit observation, and has stated that "the proceeds of cess collected and not transferred to Public Account would be transferred in subsequent year".

The CAG also brought into light the violation of accounting procedure in the GST compensation cess.

As per the approved accounting procedure, GST compensation cess was to be transferred to the Public Account by debit to Major Head "2047-Other fiscal services", the report says. Instead, the Ministry of Finance operated the Major Head '3601-Transfer of Grants in aid to States'," CAG said.

The auditor said this wrongful operations has implications on the reporting of grants n aid, since the GST Compensation Cess "is the right of the States and is not a Grant in aid".