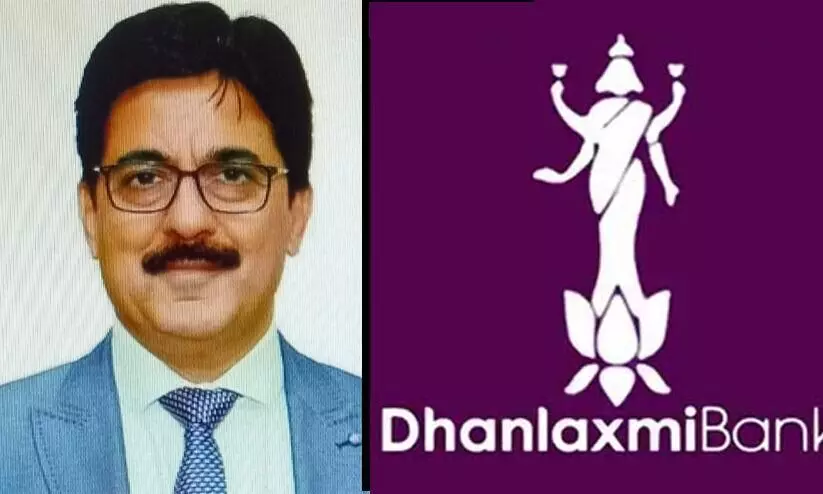

I was asked to quit on my own or be ready to be voted out, says Former Dhanlaxmi Bank CEO

text_fieldsChennai: The former Managing Director and CEO of Kerala-based Dhanlaxmi Bank Sunil Gurbaxani on Friday said he was asked to quit on September 7 itself failing which he would be voted out at the September 30 annual general meeting (AGM).

"As early as September 7, I was asked to quit on my own or I would be voted out by shareholders at the September 30 AGM. I didn't quit under pressure and hence was voted out," said Gurbaxani

"I am going back home with my head held high. It is strange that a bank Board including a Director-Shareholder who had earlier recommended my name to RBI (Reserve Bank of India) for the top position, voting against in the AGM in about seven months time. This despite the fact the bank has performed well," he added.

Gurbaxani was appointed as MD & CEO of the bank for a period of three years from February 27, 2020.

The ordinary resolution moved for Gurbaxani's appointment at the AGM was defeated, with 90.49 per cent of the votes polled against the proposal. Only 9.51 per cent of the votes were polled in favour of his appointment.

According to him, the RBI's direction to dismiss an advisor who was earlier the Chief General Manager (CGM) of the bank was not only reason for him to be voted out, but there are governance issues like the appointment of a 69-year old person as a Director and others.

"A sitting Board member voting against a sitting MD is also misgovernance. Only four or five shareholders voted against me while other resolutions were passed at the AGM," Gurbaxani said.

He also dismissed as motivated the campaign that he was for opening more branches in North India.

"We were closing down branches in North India. Further out of 40 loss making branches 15 were turned profitable. With proper technology effective control could be exercised over the branches located away from the headquarters or regional offices. That is how all the new generation private banks work. The fastest cars have the best brakes," Gurbaxani, who was earlier with Axis Bank, said.

"When there is business potential why not tap that with effective control mechanisms. As an MD & CEO it is also my duty to look at potential business areas. Similarly, should one not look for people with required skill sets in the market if such people are not there inhouse?" he asked.

"In the last six months the performance of some business segments of the bank were better than that of the last six years," Gurbaxani claimed

The total deposits have grown, the current account, savings account (CASA) grew by two per cent to 31 per cent, the new to bank business was also better and the gold loan business too grew well during the last three months, added Gurbaxani

(From IANS)