RBI directs adoption of Alternative Reference Rate by July 1 to replace LIBOR and MIFOR

text_fieldsMumbai: The Reserve Bank of India (RBI) has directed banks and financial institutions to adopt a widely accepted Alternative Reference Rate by July 1 to complete the transition from the scandal-hit London Interbank Offered Rate (LIBOR) and Mumbai Interbank Forward Outright Rate (MIFOR).

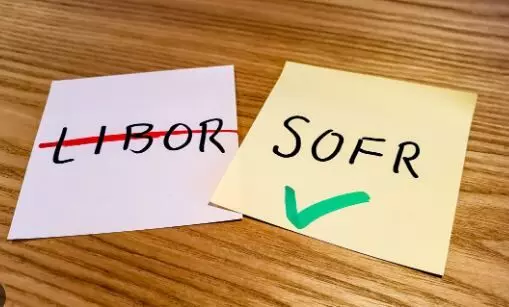

Previously, banks and private companies had used LIBOR as the benchmark rate for raising funds abroad and for setting interest rates on adjustable-rate loans, mortgages and corporate debt. However, due to its role in worsening the 2008 Financial Crisis and the LIBOR manipulation scandals, LIBOR is being phased out.

New transactions are now predominantly using the Secured Overnight Financing Rate (SOFR) and the Modified Mumbai Interbank Forward Outright Rate (MMIFOR), with SOFR being considered a more accurate and secure pricing benchmark.

The RBI expects banks and financial institutions to have developed the necessary systems and processes for a smooth transition away from LIBOR by July 1. The transition has been facilitated by the Indian Banks’ Association and other industry associations, with a longer transition period provided by the continuing publication of US$ LIBOR settings in five tenors, allowing for the insertion of fallback clauses in legacy financial contracts that reference LIBOR.

However, there have been instances of a few Dollar LIBOR-linked financial contracts undertaken or facilitated by banks and financial institutions after January 1, 2022. While banks have reported substantial progress towards the insertion of fallback clauses, the process is yet to be completed for all contracts where such fallbacks are required.

After June 30, the publication of the remaining five Dollar LIBOR settings will cease permanently. Certain synthetic settings will continue to be published after June 30, 2023, but the Financial Conduct Authority, UK, which regulates LIBOR, has made it clear that these settings are not meant to be used in new financial contracts.

The MIFOR, a domestic interest rate benchmark reliant on Dollar LIBOR, will also cease to be published by Financial Benchmarks India Pvt Ltd after June 30.