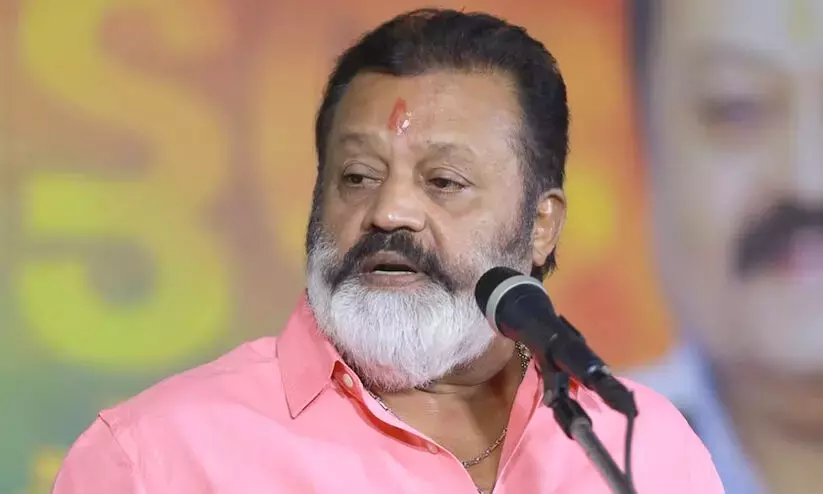

Cooperatives became "collateral damage" in note ban: CM Pinarayi

text_fieldsChennai: Hitting out at the Centre over demonetisation, Chief Minister Pinarayi Vijayan Tuesday claimed that credit cooperatives in the country have suffered collateral damage and alleged they were virtually forced to down their shutters.

The high value note ban of November 8, last year "is a Tughlak like reform," he said, adding it had resulted in credit cooperatives suffering "collateral damage," and "virtually forced to pull down their shutters."

"This is particularly so for the cooperatives in Kerala which for the past one decade have been resisting the imposition of Vaidynathan Committee recommendations," he said addressing the 28th National Conference of the All India Bank Employees Association here.

Vijayan said this was "absolute disdain" for the cooperative sector of the country which is the lifeline of rural India.

"We live in strange times when the hard earned reputation of our banks and trust of the public on banking system was eroded by those who were meant to protect it," he said.

The chief minister said the the most disheartening part of demonetisation was a conscious effort to undermine the nationalised and cooperative banks for the benefit of vested interests.

With crores of accounts and more than Rs 1.2 lakh crore deposits in primary agriculture credit societies alone, he called credit cooperatives in Kerala as strongest in India.

Cooperatives in Kerala are supported by powerful grassroot-level movement rather than being mere bureaucratic appendages of state machinery, he added.

They are the favourite financial institutions of the poor, Vijayan said, adding it extended easy loans to them and they had to face a "major impact post demonetisation", especially farmers were hit as a result.

"Now it has become clear that demonetisation has become a bigger blow to the earnings of banks....banks have not only been hit by slowing credit demand but also have to forego income on several other headsm," Vijayan said.

He quoted SBI chief economist Soumya Kanti Ghosh who had said that credit growth was the lowest in over 60 years since 1954-55 slowing down to 1.7 per cent to buttress his point that scrapping high value notes had hit the people, especially farmers and other marginalised sections.

He also praised the banking sector employees for their patience in handling the customers post demonetisation.

"Indian people and the banking system were subjected to the most brutal economic assault for the past couple of months following demonetisation," Vijayan said.