New India Cooperative Bank GM booked for ₹122 crore financial fraud

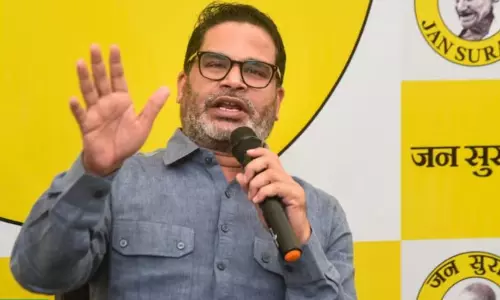

text_fieldsCustomers outside Mumbai’s New India Co-operative Bank on Feb 14 after RBI froze withdrawals and barred new loans for six months.

Mumbai: The Mumbai Police have registered a First Information Report (FIR) against the General Manager of New India Cooperative Bank, Hitesh Mehta, and several of his colleagues for their alleged involvement in a Rs 122 crore financial fraud. The FIR was lodged at the Dadar Police Station two days after the Reserve Bank of India (RBI) imposed operational restrictions on the bank due to supervisory concerns and liquidity issues.

The complaint was filed by Devarshi Shishir Kumar Ghosh, the Acting Chief Executive Officer (CEO) of the bank, under relevant sections of the Bharatiya Nyay Sanhita (BNS). The accused, including individuals holding senior positions such as General Manager and Head of Accounts, are alleged to have conspired and misused their authority to embezzle the funds.

Following the FIR, the investigation has been handed over to the Economic Offences Wing (EOW) of the Mumbai Police. The probe will be conducted under the supervision of DCP Mangesh Shinde, who oversees financial crimes related to banking.

The RBI's restrictions on New India Cooperative Bank, effective from February 13, 2025, prohibit account holders from withdrawing money from their savings, current, or other accounts. However, the bank is allowed to make loan adjustments against deposits and cover essential expenses such as employee salaries, rent, and electricity bills. Additionally, the bank is barred from selling any of its assets during the six-month restriction period.

The RBI stated that these measures have been enforced to protect the interests of depositors as the bank's financial condition had raised concerns. The restrictions have triggered panic among customers, with many rushing to the bank’s branches only to be informed that withdrawals were not permitted.

With IANS inputs